Can I Sell My Condemned House? Here’s What You Need to Know

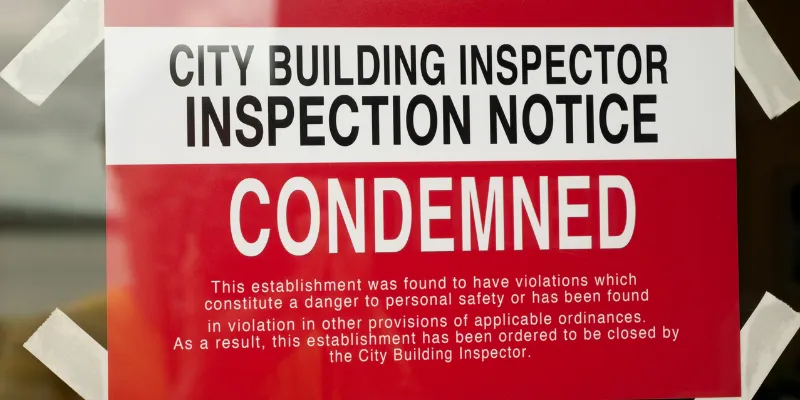

Getting a condemnation notice is enough to rattle anyone. When the city tags your front door, it can feel like your home and your future have suddenly slipped out of your hands. If you’re staring at a house deemed unlivable, it’s normal to feel anxious and overwhelmed. You’re probably wondering: Can I sell my condemned house?

The answer is yes, you can. But selling a condemned house doesn’t work like a regular home sale. The journey has its own stops, turns, and detours, and chances are, you’re looking for clear steps forward, not more confusion.

In this guide, you’ll find real answers. You’ll learn what a condemned house actually is, what typically leads to it, and the honest options you have to move on. You still have choices, even if it doesn’t feel like it right now.

What Exactly Is a “Condemned” House?

Let’s cut through the formal jargon: a condemned house is one that the local government has declared too unsafe for anyone to live in. Usually, a city or county inspector determines that the property is a threat to health or safety. It’s not a label given lightly.

Once a house is condemned, you’re required to move out immediately no loopholes. No one’s allowed to stay there or even rent it until the issues behind the condemnation are fixed and the home passes inspection.

Common Reasons a House Gets Condemned

Condemnation notices don’t show up out of nowhere. Here’s why they typically happen:

- Major Structural Damage: Houses can get blacklisted if the foundation is crumbling, the roof has caved in, or fires and floods have left the place barely standing.

- Unsafe Materials: Dangerous substances like mold, asbestos, or lead paint can trigger a notice.

- Missing or Unsafe Utilities: If there’s no running water, faulty wiring, or broken plumbing, the city can call a stop.

- Pest Infestation: Massive infestations, such as termites destroying beams or a home overrun by rats, can get a property condemned.

- Abandonment and Neglect: Homes left empty and rotting for years often land here, especially if key systems are broken.

- External Hazards: Sometimes, it’s about location. Houses near a landslide area, floodplain, or city project zone may be condemned for reasons beyond your control.

The notice from the city should lay out the exact problems. Reading it closely gives you your first clues about what’s next.

What Happens After You Get a Condemnation Notice?

That red tag isn’t the end of the story. After the shock, you still have some paths to consider:

1. Repair and Restore the Property

Your first instinct might be to fix what’s wrong. If you’ve got access to cash, have time on your side, and aren’t already stretched thin, restoring your house could be possible.

How it works:

- Figure Out What Needs Fixing: Go through the official notice and list out each violation.

- Call in Professionals: Contractors, engineers, or architects will need to assess the damage and give honest estimates.

- Seek Permits: Anything big, electrical, plumbing, or structural requires paperwork and official sign-off.

- Tackle Repairs: Every update has to meet current building codes, which may be stricter than when your house was built.

- Arrange a Reinspection: If everything checks out, the city will lift the condemnation order.

The truth:

Most folks find this route expensive and exhausting. Structural repairs, rewiring, remediating mold, or fixing plumbing can eat up tens of thousands of dollars. The emotional drain is real, and the project could drag on for months or more hard for anyone, especially if time and resources are tight.

2. Tear Down the House and Sell the Lot

If repairs are unrealistic or you’re already maxed out, demolishing the house and selling the empty land might be your next move. This is mostly about removing the problem and starting fresh.

The process:

- Get Demolition Quotes: The price tag can range from $5,000 to $20,000 or more, especially if hazardous materials are involved.

- Permitting: Like repairs, demolition needs city paperwork.

- List the Vacant Lot: Once the building’s gone, your land’s value depends on area demand and local zoning rules.

Keep in mind:

There’s an upfront cost for demolition, and selling land can be slower. Your buyers are likely to be builders or investors, which is a smaller pool than regular homebuyers.

3. Sell the Condemned House As-Is

If the thought of repairs or demo is just too much, you can still choose to sell your condemned house as-is. You don’t need to fix it, and you don’t need to tear it down. Instead, you can pass the challenge and the opportunity to someone else.

But can you really sell a condemned house fast?

The Cash Buyer Route: Selling Your Condemned House for Cash

Most regular buyers and traditional agents can’t help here. Banks won’t lend for condemned homes, and the majority of buyers want “turnkey” properties, not a pile of problems. That narrows the field to one type of customer: someone prepared to buy with cash and tackle the mess themselves.

Cash buyers, often companies or investors familiar with rough properties, can step in. Let’s break down why this approach makes sense for many homeowners:

They’ll Take the House “As-Is”

No repairs, no upgrades, no pre-sale pressure. When you find a buyer who wants the house “as-is,” it really means as-is. Foundation problems? Mold in the basement? Outdated wiring? The buyer accepts the risk and spares you the headache.

Deals Close Fast, With Cash

Because these buyers use their own money, you don’t get bogged down waiting on appraisals or bank approvals. If your city is breathing down your neck and you need out quickly, you can sell my house as-is and be done in a few weeks (sometimes less).

The Process is Simple

Here’s what you can typically expect:

- Reach Out: Give the buyer some basic details about your house.

- Schedule a Walkthrough: They come by, take a look, and check what needs attention.

- Get an Offer: They crunch the numbers and give you a direct, no-obligation offer.

- Pick a Closing Date: If you like the offer, you set a date, sign papers, and get paid.

No Extra Fees or Last-Minute Charges

Cash buyers rarely work with agents and, more importantly, they handle closing costs. That means more money in your pocket and less stress at the finish line.

Finding the Right Cash Home Buyers

You’ll see ads everywhere we buy houses in Florida, “cash home buyers near me,” and so on. Make sure you work with someone who has a solid track record. A trustworthy buyer will:

- Never rush you or make you feel trapped.

- Explain exactly how they arrive at their numbers.

- Answer every question, honestly and clearly.

- Have positive reviews from real homeowners in your area.

You deserve respect and empathy, especially at a time like this. The right buyer isn’t just there to close a deal; they’re there to help you get your life back on track.

Ready to Move Forward? Here’s What to Do Next

It might not feel like it right now, but you have more options than you think. Staring down a condemned house is exhausting, but it doesn’t have to swallow your peace of mind or your future. Repairing or tearing down the house might be right for a few, but for most people, the clear path forward is to sell a condemned property quickly and start fresh.

You don’t have to deal with endless repairs, mounting bills, or city deadlines. You can get a fair cash offer, move on your own timeline, and let someone else take it from here. If you got the notice and don’t know where to turn, reach out for a no-pressure conversation. See what your house is really worth and how soon you could put this chapter behind you.

You don’t have to go through this alone. Solutions exist. Relief is possible. And you can take the next step today.